The 10-Minute Rule for Non Profit Organizations List

Wiki Article

An Unbiased View of 501c3 Organization

Table of ContentsExamine This Report about Non Profit Organizations List501c3 - The FactsThe Ultimate Guide To Npo RegistrationThe Main Principles Of 501c3 About Non Profit Organizations Near Me501c3 Nonprofit for Dummies

While it is secure to say that a lot of philanthropic companies are honorable, organizations can definitely experience some of the same corruption that exists in the for-profit corporate globe - 501 c. The Post found that, between 2008 and 2012, more than 1,000 nonprofit companies inspected a box on their internal revenue service Type 990, the tax obligation return kind for excluded companies, that they had actually experienced a "diversion" of assets, suggesting embezzlement or various other fraud.4 million from acquisitions linked to a sham service started by a previous aide vice president at the organization. Another instance is Georgetown University, that endured a considerable loss by an administrator that paid himself $390,000 in added settlement from a secret checking account previously unidentified to the university. According to government auditors, these stories are all also common, as well as serve as cautionary stories for those that seek to develop and operate a charitable company.

When it comes to the HMOs, while their "promotion of health and wellness for the benefit of the community" was considered a philanthropic function, the court determined they did not run mostly to profit the community by supplying health solutions "plus" something added to benefit the area. Therefore, the abrogation of their excluded condition was upheld.

The 7-Minute Rule for Nonprofits Near Me

In addition, there was an "overriding government interest" in forbiding racial discrimination that surpassed the college's right to totally free exercise of faith in this way. 501(c)( 5) Organizations are labor unions as well as agricultural as well as horticultural organizations. Organized labor are companies that create when employees associate to engage in collective negotiating with an employer regarding to salaries as well as benefits.By comparison, 501(c)( 10) companies do not offer settlement of insurance coverage advantages to its participants, and also so may prepare with an insurance provider to supply optional insurance policy without threatening its tax-exempt status.Credit unions and also other common monetary organizations are classified under 501(c)( 14) of the internal revenue service code, and also, as component of the banking sector, are heavily managed.

Little Known Facts About Npo Registration.

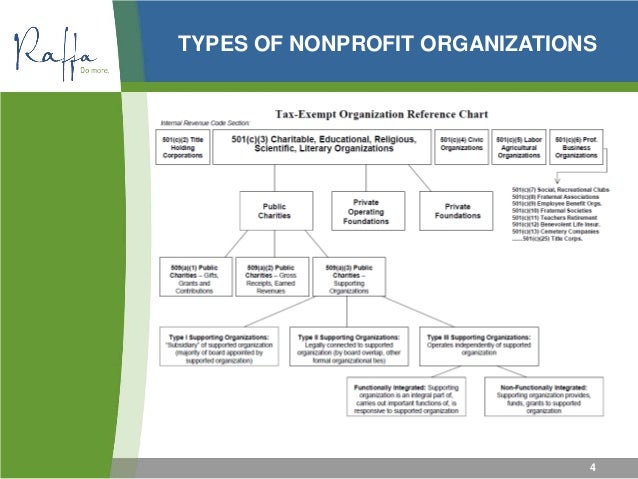

Getty Images/Halfpoint If you're taking into consideration beginning a not-for-profit company, you'll intend to recognize the different kinds of not-for-profit classifications. Each classification has their own demands as well as compliances. Here are the sorts of nonprofit classifications to assist you determine which is ideal for your organization. What is a nonprofit? A nonprofit is an organization operating to enhance a social reason or support a common goal.Offers payment or insurance to their members upon health issues or other traumatic life occasions. Membership has to be within the exact same work environment or union.

g., online), also if the nonprofit does not straight solicit donations from that state. Additionally, the internal revenue service needs disclosure of all states in which a nonprofit is signed up on Going Here Form 990 if the nonprofit has earnings of greater than $25,000 annually. Penalties for failure to register can consist of being required to repay donations or facing criminal costs.

Non Profit Fundamentals Explained

com can help you in registering in those states in which you mean to solicit contributions. A not-for-profit organization that obtains considerable portions of its earnings either from governmental sources or from direct payments from the public might certify as an openly supported organization under area 509(a) of the Internal Revenue Code.

Due to the intricacy of the legislations as well as guidelines governing designation as an openly supported organization, incorporate. com recommends that any type of not-for-profit thinking about this designation seek legal as well as tax obligation advise to offer the necessary advice. anchor Yes. The majority of individuals or teams develop not-for-profit firms in the state in which they will primarily operate.

A not-for-profit firm with business locations in several states might develop in a solitary state, after that register to do company in other states. This implies that nonprofit corporations have to officially register, file yearly reports, and also pay yearly costs in every state in which they perform business. State laws call for all not-for-profit companies to preserve a signed up address with the Secretary of State in each state where they work.

Examine This Report about Npo Registration

Area 501(c)( 3) charitable companies may not interfere in political campaigns or conduct considerable lobbying tasks. Consult a lawyer for more particular information about your company. Some states just call for one supervisor, but the bulk of states call for a minimum of 3 directors.

Nonprofit firms, contrary to their name, can make a revenue however can not be made mostly for profit-making., have you assumed about organizing your venture as a not-for-profit company?

Indicators on Npo Registration You Should Know

With a not-for-profit, any type of cash that's left after the company has actually paid its costs is placed back right into the company. Some kinds of nonprofits can obtain contributions that are tax deductible to the individual that adds to the company.Report this wiki page